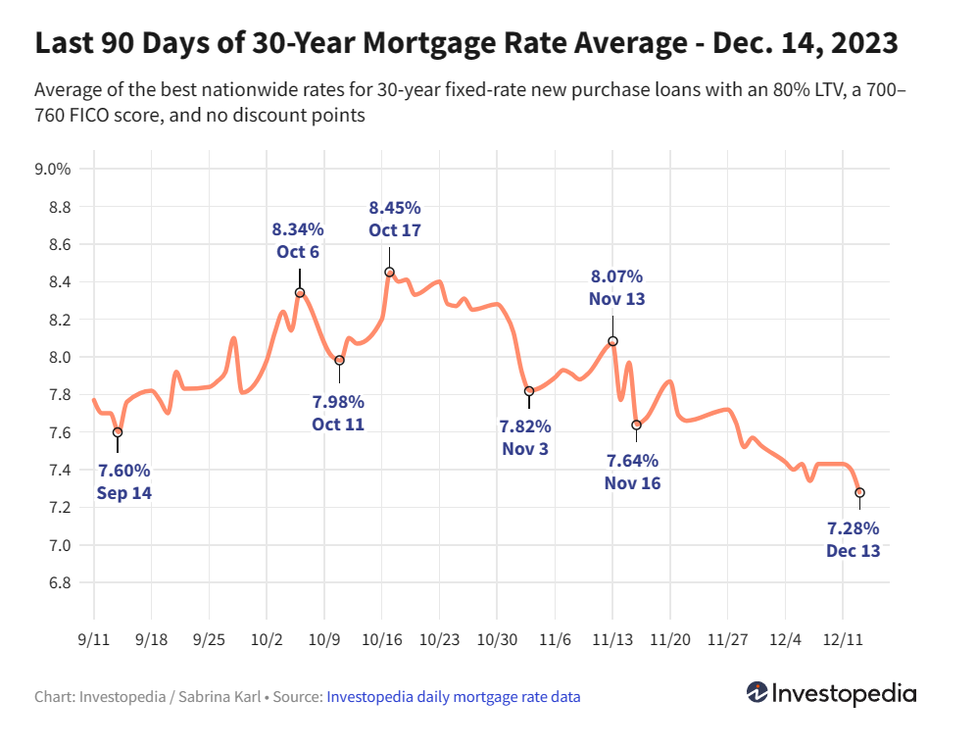

The current landscape of mortgage rates presents an unprecedented opportunity for potential homebuyers, with rates hitting their lowest levels since July. Just one month ago, a conventional loan with a 7.99% interest rate and 1 point was considered a standard offering. Fast forward to today, and we're witnessing a significant drop to 6.99%, accompanied by a palpable reduction in monthly payments. We'll delve into the numbers later in the blog, exploring how these changes can empower potential homebuyers to buy today.

The additional insight into the Federal Reserve's forecast further illuminates the potential trajectory of interest rates in the coming months.

Federal Reserve's Forecast: The Federal Reserve's indication of up to three rate cuts next year marks a significant shift from a hawkish to a more dovish stance. While the implementation of these cuts may not commence until the summer and is data-dependent, this shift bodes well for the future of interest rates.

Strategic New Home Purchases: The strategic balance lies in encouraging individuals to consider purchasing homes now. For those with homes set to deliver in the third quarter, the prospect of benefiting from existing incentives and potentially doubling down on the advantage of even lower rates in the future is compelling.

Opportunities for Builder Funded Incentives: Homebuyers in the market for properties with delivery dates in the third quarter can capitalize on this unique window. Taking advantage of current incentives, combined with the potential for further rate cuts, creates a scenario where buyers could secure not only attractive incentives but also lock in historically low interest rates!

The Previous Scenario:

One month ago, a $700,000 home purchase with a mortgage amount of $560,000 carried a 7.99% interest rate plus 1 point. This resulted in a principal and interest (P&I) payment of $4105.18 per month.

Loan Details:

Purchase Price: $700,000

Mortgage Amount: $560,000

Interest Rate: 7.99% Points: 1 (1% of the loan amount)

P&I Payment: $4105.18

The Current Advantage:

Today's scenario presents a more favorable landscape for homebuyers. With the same 1 point (1% of the loan amount), the interest rate has dropped to 6.99%, resulting in a reduced monthly payment.

Loan Details:

Purchase Price: [Variable based on increased mortgage amount]

Mortgage Amount: [Variable based on increased mortgage amount]

Interest Rate: 6.99% Points: 1 (1% of the loan amount)

P&I Payment: $3721.93

Monthly Savings and Increased Purchase Power: The drop in interest rates equates to a substantial monthly savings for homebuyers.

Monthly Savings:

$4105.18 (Previous P&I) - $3721.93 (Current P&I) = $383.25

This monthly savings of $383.25 enables borrowers to redirect these funds to either increase their mortgage amount or explore higher-priced homes.

Increased Mortgage Amount: $383.25 (Monthly Savings) / $6.65 (New Interest Rate per $1000) = $57,744

The current mortgage market conditions are undeniably favorable for potential homebuyers. With interest rates dropping, monthly payments are reduced, allowing borrowers to either pocket the savings or, more strategically, leverage it to increase their mortgage amount. This means that homebuyers can now consider properties with higher purchase prices, expanding their options in the ever-evolving landscape of real estate financing.

As the market continues to evolve, it's essential for both prospective homebuyers and industry experts to remain attuned to these changes. Navigating the complex landscape of real estate financing requires a keen understanding of the current environment, future projections, and the ability to make informed decisions. Whether it's seizing the present opportunity or strategically planning for the future, this is undoubtedly a pivotal moment for those looking to make a move in the real estate market. Reach out to our Mortage Coaches at Better Built Mortgage to get your questions answered!

Better Built Mortgage Group, LLC, NMLS #2410554. This is not an offer to enter into an agreement. Any such offer may only be made in accordance with Minn. Stat. 47.206(3) & (4). The material provided here is intended as educational and informational only and is for distribution to real estate or financial professionals and is not intended for distribution to consumers; this does not constitute an offer to lend or to recommend available products.